43 why do companies do stock splits

Why Do Companies Do Stock Splits? - Yahoo The question of why companies engage in stock splits is one I've pondered for some time, and is one most financial advisors will say ultimately doesn't matter from the perspective of the underlying business behind the stock split. A stock split involves a company, which has typically seen its stock price appreciate considerably, exchange a ... What Is A Stock Split? - Forbes Advisor Why Do Companies Split Stock? In many cases, a stock split is a strategy used by companies to meet a specific goal, says Amanda Holden, a former investment counselor and the founder of Invested ...

Why Do Companies Like MRF Don't Split the Stock? | Trade ... Here are four common reasons why companies split their shares- Stock splits help the companies to make the share price affordable for retail investors. For example, if a company is trading at a share price of Rs 3000 and it offers a stock split of 10:1, then it means that its price will drop to Rs 300 per share after the split.

Why do companies do stock splits

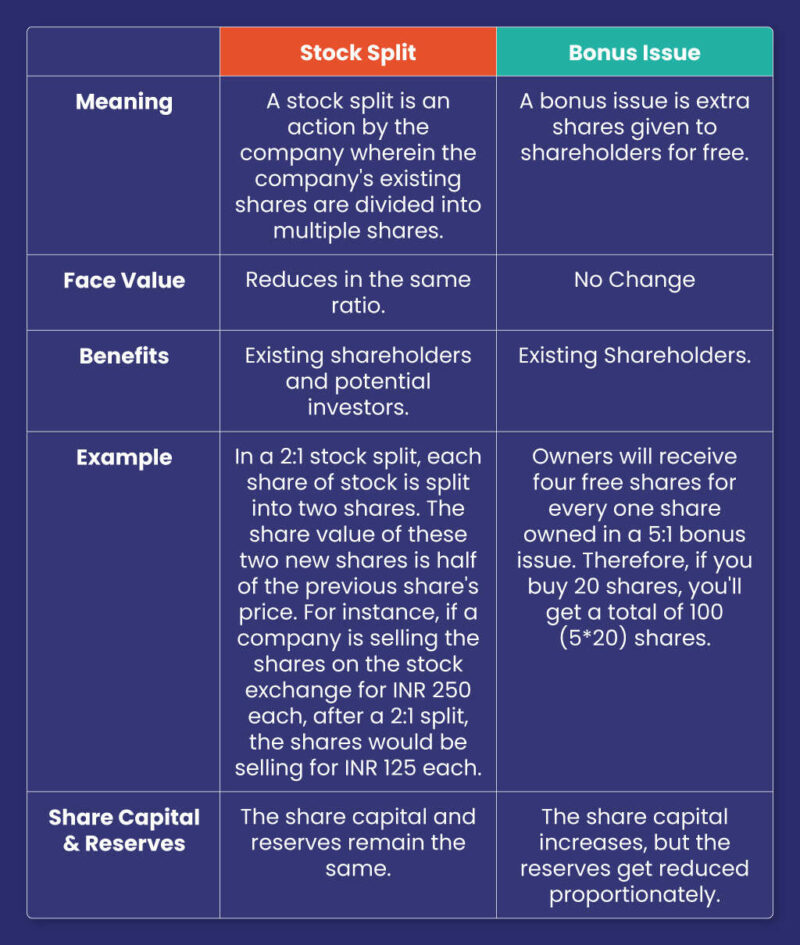

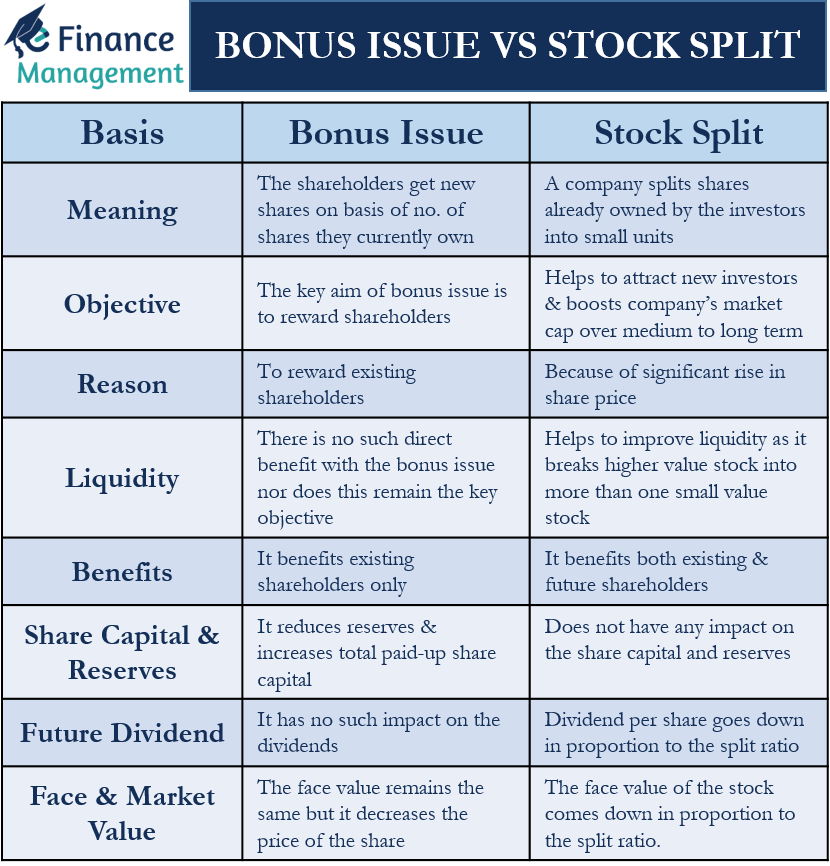

Why do companies not prefer stock splits? - Finology Companies can increase their liquidity through stock splits because it causes an increase in the trading volume of their stock. Companies also prefer to opt for a stock split when they want their stock to be concentrated with a smaller number of shareholders. Stock splitting helps companies to build a diversified investor base for their stock. Why Some Companies Don't Split Their Stock - The Balance Why Split Stock Shares? One of the main reasons a company might split its stock is to expand its shareholder base. A split will make shares more affordable for more people, and some companies prefer to avoid seeing their shares concentrated on a small group of people. Stock Split: Why A Company Splits Stock? Explained with ... Prime Reasons of a Stock Split: So if the market cap doesn't change, who do companies opt for it? Increased number of shares brings the share price down; the company can control the market share price without any bad signaling effect. A stock split brings the share prices down that make it more convenient for common investors to buy the shares.

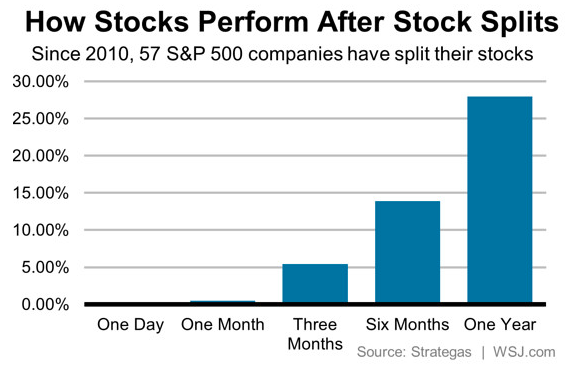

Why do companies do stock splits. Why Do Stocks Split? Why do Companies Split Their Stocks? Companies used to get concerned when the share price of their stock rose too high. It was believed that a higher stock price would prevent most smaller investors from being able to invest in the company. This would mean the stock would primarily be traded by institutional investors. Why do Companies Perform Reverse Stock Splits? - Reverse ... In his dissertation for Florida State University, Barry Marchman identifies four reasons why a company would effect a reverse split. 1) Complying with listing requirements Nasdaq, the New York Stock Exchange, and AMEX require that securities maintain a share price greater than $1. Lorimer Wilson Blog | Stock Splits: Why Do Companies Do ... Nasdaq found that companies that split their stock outperformed the market. This is likely due to investor excitement and the fact that companies often split their stock as they approach periods of growth. 3. Reducing Capital Costs Stocks with prices that are too high have spreads that are wider than similar stocks. What Is a Stock Split and Why Do Companies Do Them? | The ... Stock splits are often not well understood by investors. Shareholders tend to like them in part because a split creates the impression of owning more. Of course, having a 2-for-1 split does not...

› category › marketsMarkets Archives - Visual Capitalist A Visual Guide to Stock Splits If companies want their stock price to rise, why would they want to split it, effectively lowering the price? This infographic explains why. Why Would a Company Perform a Reverse Stock Split? Key Takeaways A company performs a reverse stock split to boost its stock price by decreasing the number of shares outstanding. A reverse stock split has no inherent effect on the company's value,... Why giant companies are suddenly splitting into pieces - CNN Breaking up is the newest craze for ginormous global companies. Johnson & Johnson, Toshiba and GE announced plans to split into multiple entities this week. The trend may have only just begun. Why do companies split their stocks? What are the advantages? A stock split is a decision by a company in which a company increases the number of its outstanding shares by issuing more shares to current shareholders. The primary motive of a stock split is to make shares seem more affordable to small investors. Let's take Apple Case Current Apple stock price = $500 No. of Apple shares you own = 10

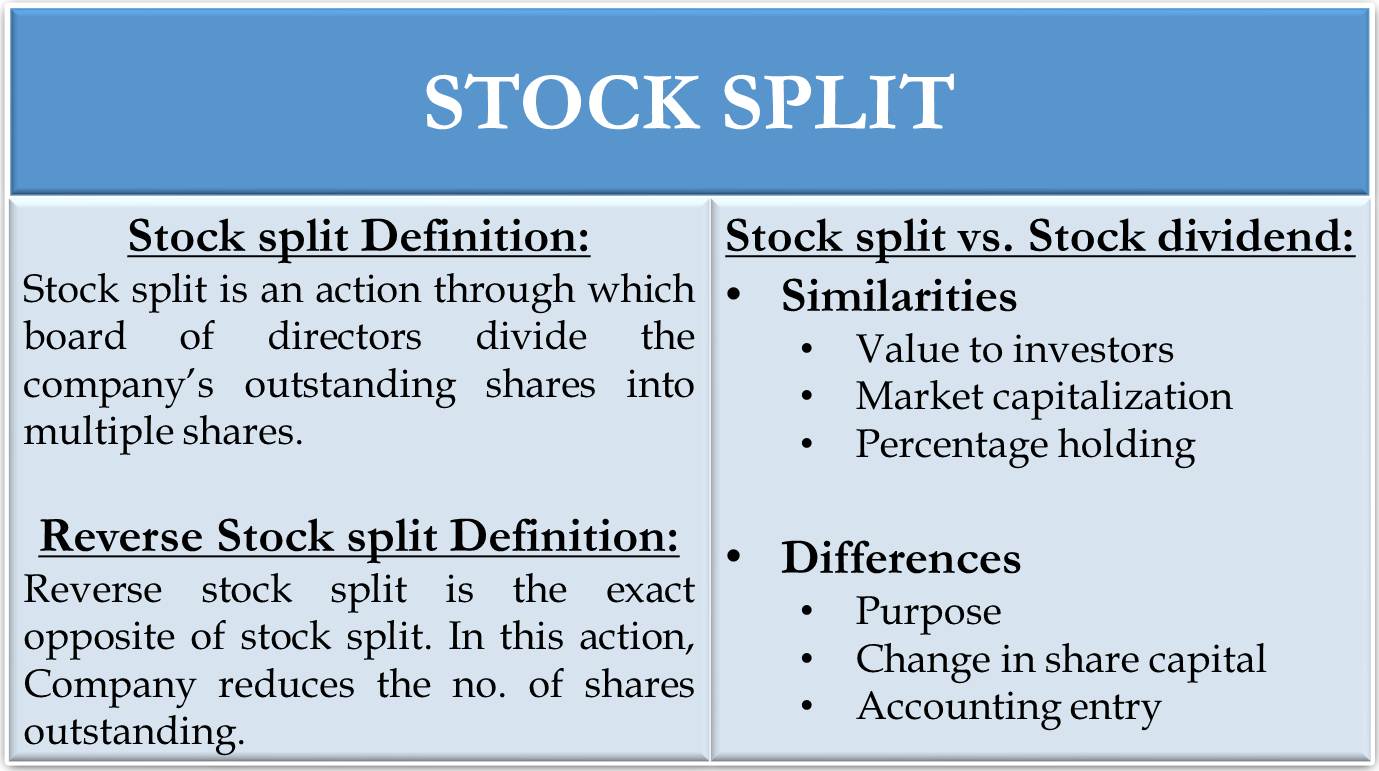

Why Do Companies Split Their Stock? - Modern Money While stock splits represent a superficial change that should have no impact on market cap, there does clearly come a point where liquidity can be hindered by a rising stock price. Apple's planned stock split on August 31, 2020 will be the fifth split in the company's history - 1 share held in 1987 would be 224 shares today. Why Do Stocks Split and How Does It Benefit a Company? Companies might do a stock split to increase liquidity and appeal to more retail investors. Keep reading to learn how stock splits benefit companies. › ask › answersWhy Do Companies Engage in Stock Splits? - Investopedia A stock split is used primarily by companies that have seen their share prices increase substantially. Although the number of outstanding shares increases and the price per share decreases, the... What is a Stock Split, and Why Do Companies Do Them? Occasionally, companies perform reverse stock splits- which are, as you may have guessed, the opposite of stock split. This is when a company divides the number of shares and the share price increases. If a company issues a 1-for-4 reverse split, you will receive 1 share for every 4 shares you held.

› preferred-stock-definition-vsPreferred vs. Common Stock - The Balance Nov 23, 2021 · Companies also use preferred stocks to transfer corporate ownership to another company. For one thing, companies get a tax write-off on the dividend income of preferred stocks. For example, if a company owns 20% or more of another distributing company's stock, they don't have to pay taxes on the first 65% of income received from dividends.

Why would a private company split stock? - Quora Keep in in mind that the most important reason why a public company split its stocks, is to make it available to a wider cross section of the Public. Just because a share is popular, and many people want a piece of the company don't mean it must split. Excess demand for a commodity will cause the price to rise.

Stock splits: What they are, why they happen and what they ... Why do companies split their stocks? Basically, it's optics. Companies usually split their stocks once they perceive the share price has grown "too expensive" for mainstream investors.

What Are Stock Splits & Reverse Splits? Definition ... Why Do Companies Perform Stock Splits? A company may choose to split its stock for a number of reasons. Most commonly, splits are performed to increase liquidity by increasing the number of shares...

time.com › nextadvisor › investingWhat Is a Stock Split & What Causes It? | NextAdvisor with TIME Jan 27, 2022 · Why Companies Do Stock Splits. A stock split is often a sign that a company is thriving and that its stock price has increased. While that’s a good thing, it also means the stock has become less ...

Jeff Desjardins Blog | A Visual Guide To Stock Splits ... Like wheels of cheese, stocks can be split in a number of different ways. Some of the more common splits are 2-for-1, 3-for-1, and 3-for-2. Less common splits can take place as well, such as when Apple increased its outstanding shares by a 7-to-1 ratio in 2014. Why Companies Do Stock Splits. Of course, stocks aren't cheese.

4 Reasons for a Reverse Stock Split - Cabot Wealth Network So, if the market views reverse stock splits with a jaundiced eye, you may ask, why would a company decide to do such a split? The reasons are varied, and include: 1. The desire to increase the share price, especially if the shares are penny stocks.

What is a Stock Split and Why do Companies Do It ... In the end, there are some solid, very logical reasons for performing stock splits. However, some of the biggest reasons actually have more to do with public perception and crowd psychology than...

2022 Stock Split Calendar | Reverse Stock Splits | MarketBeat In this case, a reverse stock split may make investors perceive their stock as being on par with other similar companies. Why Does a Stock Split Matter? Stock splits are a corporate practice that effectively increases or decreases the number of outstanding shares while lowering or raising the price per share by a specified factor.

Why Aren't Companies Splitting Their Stocks Anymore ... Since stock splits slash the price tag of a stock, it would make sense that management wants to keep prices elevated by avoiding splits. A higher price sets a higher barrier to market entry for...

A Visual Guide to Stock Splits - Visual Capitalist Nasdaq found that companies that split their stock outperformed the market. This is likely due to investor excitement and the fact that companies often split their stock as they approach periods of growth. 3. Reducing Capital Costs Stocks with prices that are too high have spreads that are wider than similar stocks.

Why Do Companies Split Their Stock? - Eiger Wealth Why Do Companies Split Their Stock? Price per share for Apple and Tesla reached a high of $505.76 and $2,318.50 respectively on Friday, August 28. The very next trading day, Monday, August 31, the share prices for these two companies reached a low of $126.00 and $440.11.

Why Do Companies Offer Stock Splits? - Yahoo Related: Splitsville: Why Big Stock Splits Usually Warn The End Is Near So what happens when a stock splits? The company's outstanding shares increase while the price per share decreases. For ...

› en › news-and-trade-ideasApple Stock Split History: Everything you Need to Know - IG Aug 28, 2020 · Apple stock split example. An investor buys a share in Apple in January 2005, so they have one share worth $77.00. After the two-for-one stock split a month later, they own two shares in Apple, but each of these shares is worth half the amount, at $38.50.

Stock Split: Why A Company Splits Stock? Explained with ... Prime Reasons of a Stock Split: So if the market cap doesn't change, who do companies opt for it? Increased number of shares brings the share price down; the company can control the market share price without any bad signaling effect. A stock split brings the share prices down that make it more convenient for common investors to buy the shares.

Why Some Companies Don't Split Their Stock - The Balance Why Split Stock Shares? One of the main reasons a company might split its stock is to expand its shareholder base. A split will make shares more affordable for more people, and some companies prefer to avoid seeing their shares concentrated on a small group of people.

Why do companies not prefer stock splits? - Finology Companies can increase their liquidity through stock splits because it causes an increase in the trading volume of their stock. Companies also prefer to opt for a stock split when they want their stock to be concentrated with a smaller number of shareholders. Stock splitting helps companies to build a diversified investor base for their stock.

/stock-market-data-with-uptrend-vector-183766131-ca2f390eb868433c958f05565bcb23da.jpg)

/understandingstocksplits-01736870d7244174a4a4a70eea2faa02.jpg)

0 Response to "43 why do companies do stock splits"

Post a Comment